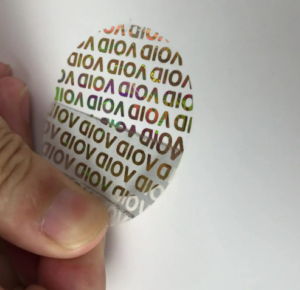

Tax labels (or tax invoices) are labels used to identify the tax status of products, usually affixed to products such as tobacco and alcohol that are subject to consumption tax. The main function of tax labels is to prove that the product has paid relevant taxes and fees in accordance with the law and meets legal sales requirements. It is not only a tool for the government to manage taxes, but also an important means to combat illegal sales and counterfeit and shoddy products.

Tax labels usually have anti-counterfeiting functions, and may use special paper, printing technology, barcodes or QR codes to prevent counterfeiting and ensure the legality and tax compliance of products. Consumers can use tax labels to determine whether the product comes from formal channels, which is particularly important for certain high-tax products (such as tobacco and alcohol).

For the government, tax labels help monitor the circulation of goods, increase tax revenue, and prevent tax evasion; for enterprises and consumers, tax labels can ensure the operation of legal markets and enhance consumer security.

评价

目前还没有评价